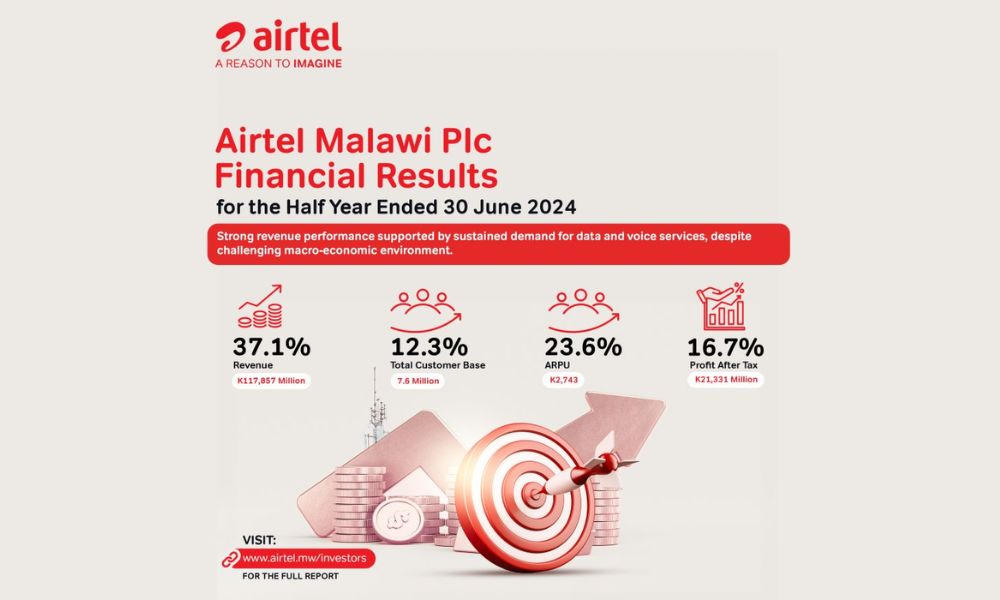

Airtel Malawi Reports 37.1% Revenue Growth Amid Economic Challenges

Airtel Malawi has delivered strong financial and operational performance for the half-year ended 30 June 2024. The company’s customer base grew by 12.3%, reaching 7.6 million, with mobile data customers totaling 2.5 million. The average revenue per user (ARPU) increased by 23.6%, driven by higher demand for both voice and data services, as data traffic surged by 41%. Revenue increased by 37.1% to K117,857 million, with voice revenue growing 29.2% and data revenue rising 53.7%. EBITDA rose by 25.9%, reaching K51,237 million, although the EBITDA margin saw a decline to 43.5% due to inflationary pressures caused by the currency devaluation in November 2023.

Despite these challenges, the company remains focused on cost optimization efforts to mitigate the impact of rising costs in fuel and electricity. Finance costs surged by 184%, primarily due to foreign exchange losses and increased interest on lease liabilities, leading to a total finance cost of K20,495 million. Nevertheless, Airtel Malawi’s profit after tax grew to K21,331 million, up from the restated K18,285 million in the previous period, bolstered by strong revenue and EBITDA growth.

Capital expenditure rose sharply by 178.1% to K15,482 million as the company continued to invest in future growth. However, due to ongoing macroeconomic uncertainties, the Board of Directors did not declare an interim dividend, while indicating that the financial year-end outlook may allow for a final dividend consideration.

The company’s leverage increased to 1.19x, primarily due to the revaluation of USD-denominated balance sheet liabilities following the devaluation of the Malawi Kwacha, though operational improvements brought leverage down from the previous 1.27x at the close of 2023.