Ghana’s NCA and Key Institutions Collaborate to Advance Digital Financial Security

This initiative aligns with the NCA’s mandate to protect consumers, promote innovation, and foster a secure digital environment that supports Ghana’s growing financial technology sector.

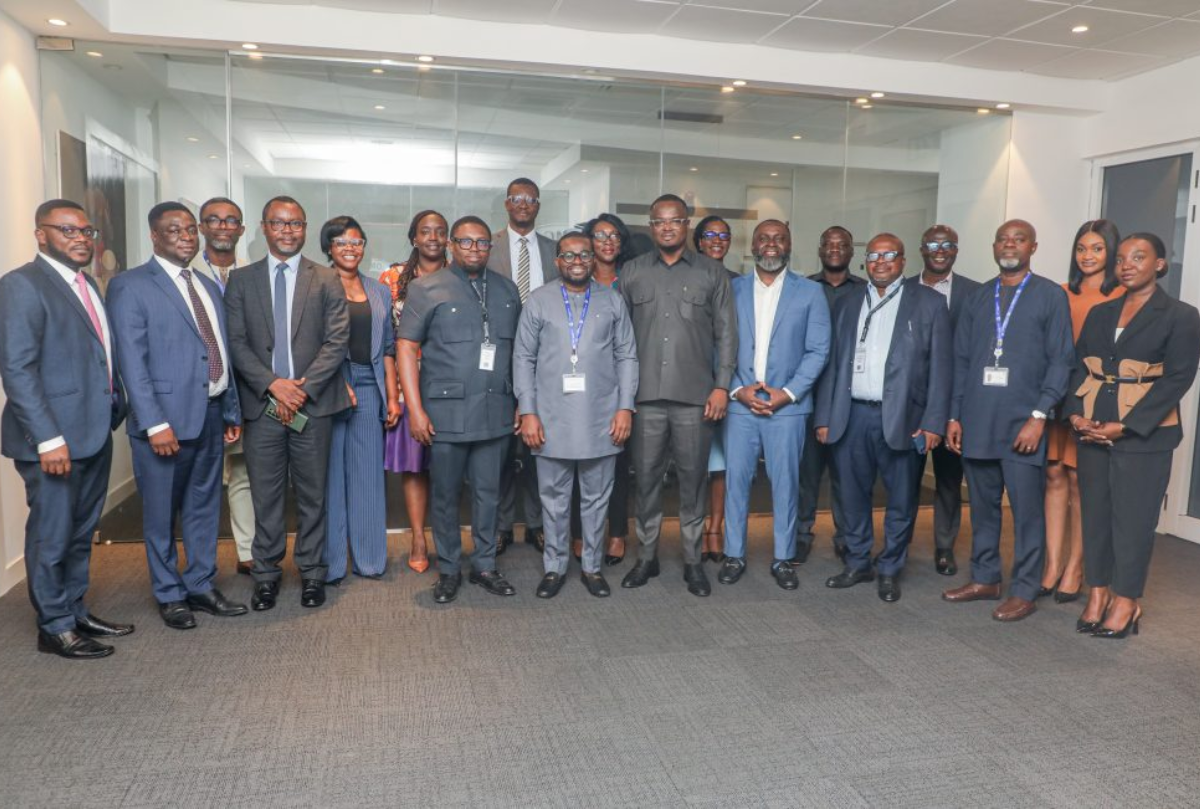

The National Communications Authority (NCA) has hosted a high-level stakeholder meeting at the NCA Tower aimed at advancing security, trust, and regulatory collaboration in Ghana’s Digital Financial Services (DFS) ecosystem.

The meeting brought together key institutions, including the International Telecommunication Union (ITU), the West Africa Telecommunications Regulators Assembly (WATRA) , the Bank of Ghana (BoG) , and the National Identification Authority (NIA) , to deliberate on strategies to enhance public confidence in mobile money and other digital payment platforms.

Speaking at the meeting, the Director General of the NCA, Rev. Ing. Edmund Fianko, noted that such collaboration had become necessary as the financial sector continued to evolve. He stressed that, to ensure confidence in the use of these financial services, systems must be established to guarantee consumer safety. While acknowledging that the NCA is not directly responsible for mobile money transactions, he observed that the Authority still receives several related complaints, highlighting the need for further action.

“Mobile money customers were first telecom customers. We need to collaborate to ensure that users of these services have full confidence in them.”

– Rev. Ing. Edmund Fianko, Director General, NCA

Rev. Ing. Fianko further hinted that the NCA and the Bank of Ghana would soon sign a Memorandum of Understanding (MoU) to guide the development of harmonised regulations in this space. These measures, he explained, aim to close loopholes that could be exploited by bad actors and to safeguard the integrity of financial systems.

A key outcome of the meeting was a commitment to develop a clear roadmap and to establish a DFS Security Test Laboratory in Ghana. This facility will enable Ghana to conduct independent security testing for mobile payment applications in line with the DFS Security Assurance Framework and ITU recommendations.

This initiative aligns with the NCA’s mandate to protect consumers, promote innovation, and foster a secure digital environment that supports Ghana’s growing financial technology sector.

The meeting was attended by the Acting Chief Executive Officer (CE0) of the National Identification Authority (NIA), Mr. Wisdom Yayra Koku Deku and representative from the Bank of Ghana (BoG).