South Africa’s Banking Sector Expands into Telecoms with Nedbank Connect

The move positions the bank alongside other financial giants that have extended their services beyond traditional banking into the telecoms arena.

South Africa’s banking sector is fast emerging as a new player in mobile connectivity, with Nedbank officially rolling out Nedbank Connect , its own mobile virtual network operator (MVNO). The move positions the bank alongside other financial giants that have extended their services beyond traditional banking into the telecoms arena.

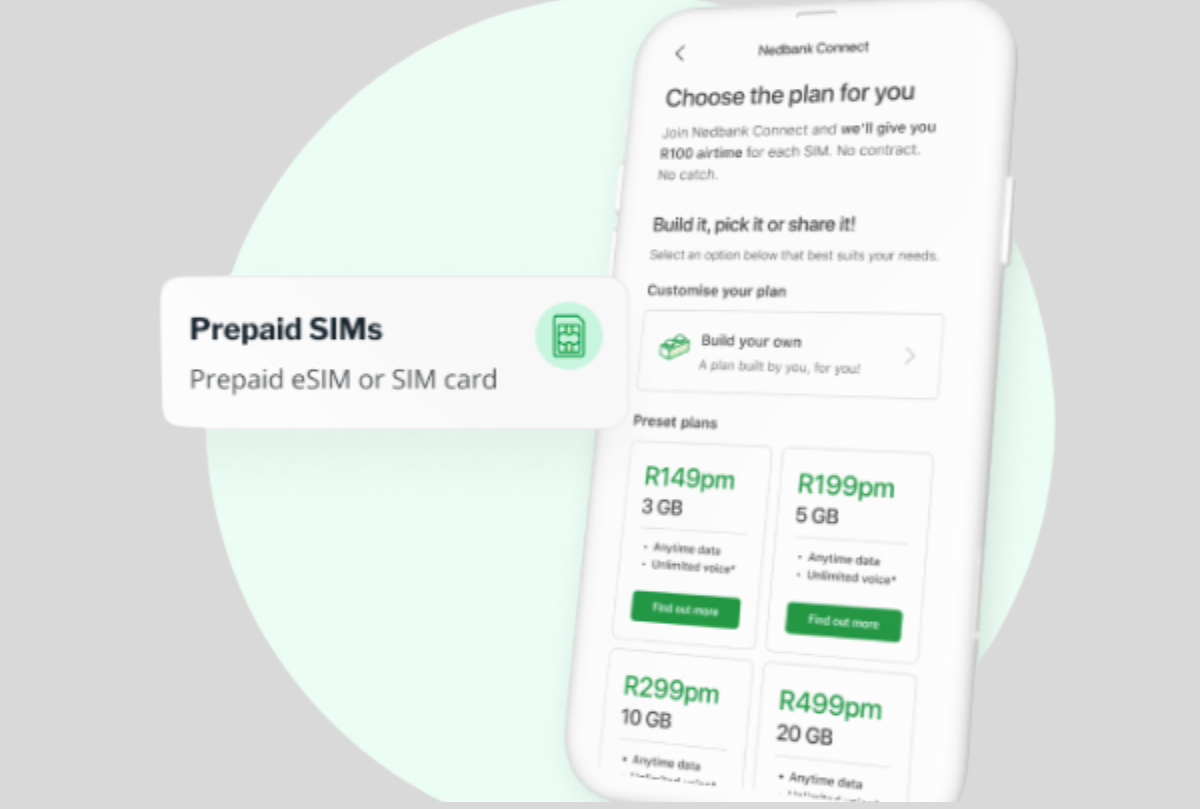

The new service, available exclusively to Nedbank account holders through the Nedbank Money App and Online Banking, is designed to seamlessly integrate with the bank’s existing digital and rewards ecosystem. Customers can choose between four contract plans ranging from 3GB at R169 to 20GB at R499 per month, or opt for prepaid SIM and eSIM options with bundles starting as low as R5.

Nedbank Connect comes with several incentives, including airtime rewards linked to the Greenbacks programme, where customers can earn up to R300 or convert existing rewards into airtime. Each new SIM is bundled with R100 free airtime, while subscribers also enjoy access to roaming services, 24/7 customer support, unlimited calls of up to 60 minutes per month, and in-branch service options. Customers can also port their existing numbers, with the process typically taking up to two days.

Getting started requires opening a Nedbank account, followed by a once-off initiation fee and a R99 SIM delivery cost. Monthly charges only begin once the SIM is activated.

With the launch of Nedbank Connect, the bank joins a growing group of financial institutions diversifying into mobile networks. FNB Connect has led the way since 2015, Capitec Connect has quickly gained traction with significant market growth, and Standard Bank Connect has continued to expand after its rebrand.

The rise of bank-led MVNOs signals a broader industry shift where financial institutions leverage their extensive customer bases and brand trust to create bundled solutions that merge banking and telecommunications. This approach not only deepens customer engagement but also opens up fresh revenue opportunities in a competitive digital economy.