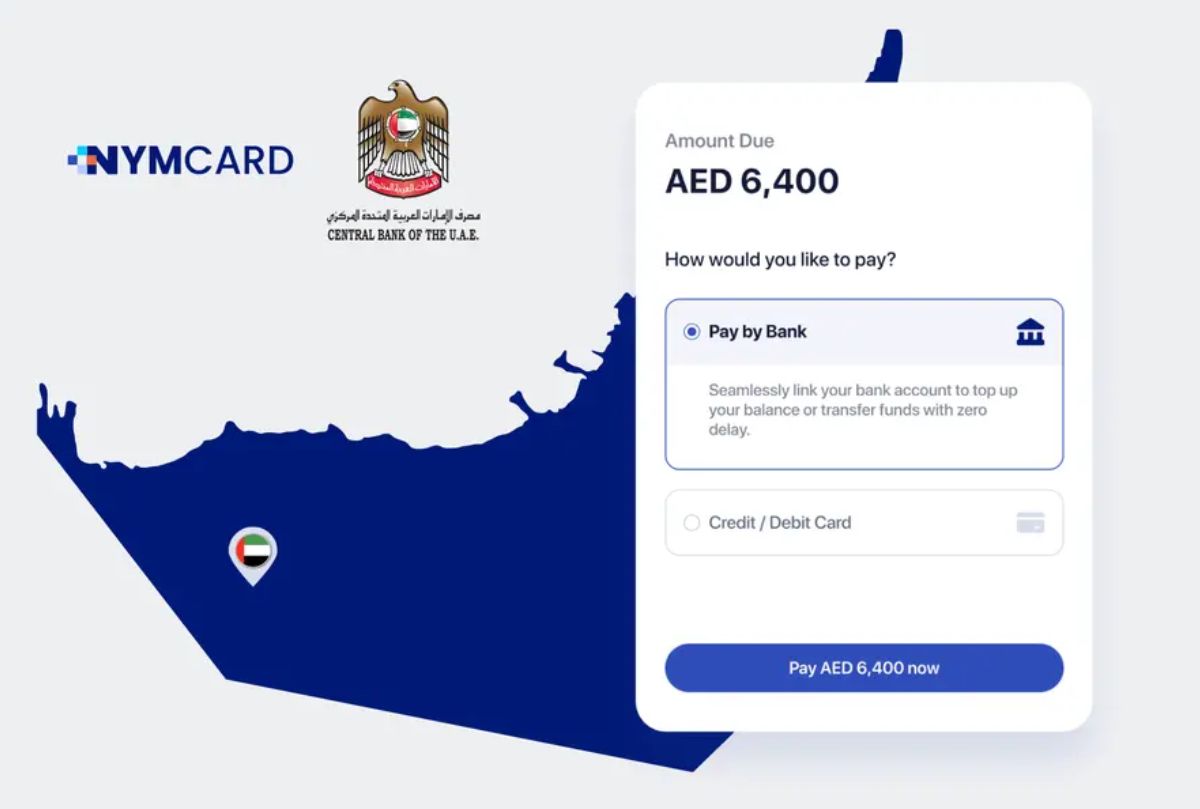

NymCard Secures UAE Central Bank License for Open Finance Services

NymCard secures UAE Central Bank license for Open Finance, becoming a leading provider of secure, regulated embedded financial services.

NymCard , the MENA region’s leading embedded finance platform, announced that it is now officially licensed to provide Open Finance services under the Central Bank of the UAE’s Open Finance regulation.

With this milestone, NymCard becomes one of the first entities in the UAE to embed regulated payment functionality within a broader financial infrastructure through one modular platform.

Open Finance is a pivotal shift in how financial products are built and delivered. This milestone reflects our commitment to advancing the UAE’s financial ecosystem by delivering impactful financial experiences.

– Omar Onsi, CEO, NymCard

Unlike providers focused solely on connectivity, NymCard provides complete financial products through a single integration. This positions NymCard to serve a broad range of sectors including fintechs, SMEs, micro-SMEs, banks, and marketplaces looking to embed regulated financial capabilities into their user journeys.

We’re enabling real-world payment use cases through secure, consent-driven A2A flows—giving consumers more choice and merchants a faster, more cost-efficient alternative. It’s a major step toward building a more open and accessible payment landscape within a fully regulated framework.

– Ihsan Alhayek, SVP – Open Financeat, NymCard

This announcement follows NymCard’s recent $33M Series B funding round led by QED Investors, and further strengthens its position as the region’s most comprehensive embedded finance provider.